Scaling smarter: A modern solution for regulatory compliance

As financial institutions grow, so do their regulatory challenges. Yet many compliance teams still rely on fragmented systems and manual processes, leaving them exposed to inefficiencies, gaps, and penalties.

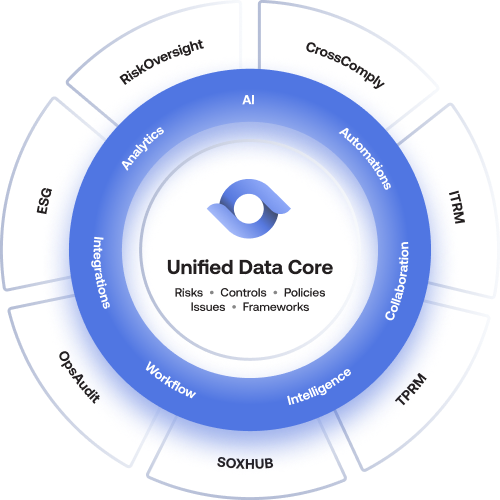

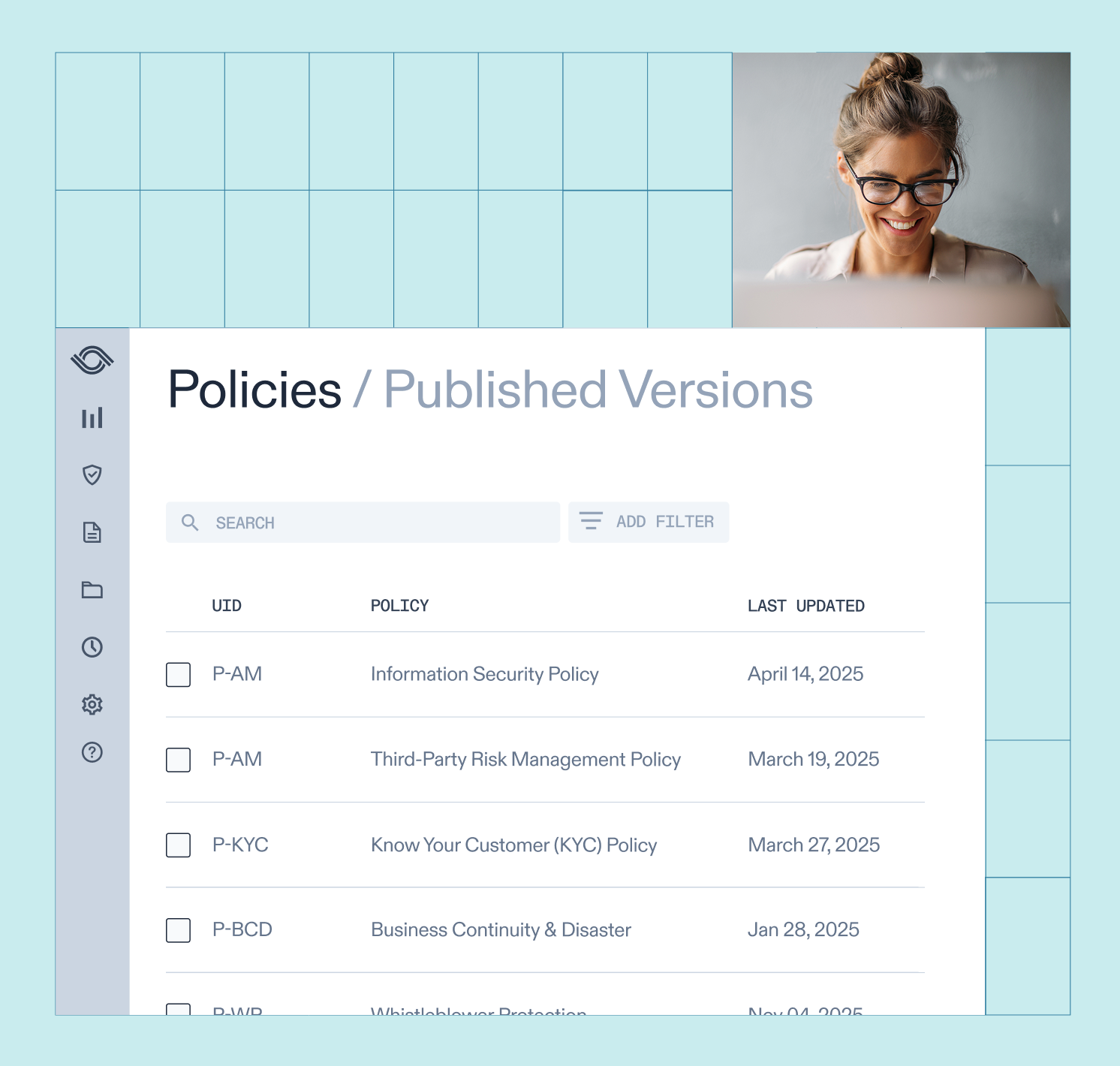

Join us for a live product walkthrough of our regulatory compliance solution. We’ll walk through how banks, insurance companies, and other financial institutions are scaling smarter with a connected solution that integrates risk and compliance in one place. We’ll show how to:

- Centralize and map regulatory obligations

- Connect controls to enterprise risks

- Streamline workflows across teams

Register Now!

Learning Objectives:

- Identify the risks and inefficiencies of siloed compliance and risk programs.

- Demonstrate how a modern compliance solution connects controls to enterprise risk.

- Apply practical steps to improve compliance workflows and regulatory readiness using integrated software.

*Please note that CPE credits are not offered for this live product walkthrough.